肥料的产量效应effect of fertilizer on cropyield

施肥对作物产量的效果。它反映一定条件下施肥量与作物产量间的数量关系,是研究肥料经济效益的基础。由于作物产量受品种、土壤、气候和栽培管理技术等综合因素的影响,肥料效应必然随上述综合因素的改变而发生变化。因此,只有正确掌握肥料效应的变化规律及其与诸影响因素的关系,才能探明经济最佳施肥量和养分的经济最佳配比,以最小的肥料投资获得最大的经济效益。

施肥量与产量间的关系 在一定的作物类型、土壤、气候和栽培管理条件下,施肥与产量间存在着一定的数量关系。19世纪80年代,H.赫尔里格尔(Hell-riegel)作了第一个完善的大麦氮素砂培试验,结果表明,随着氮肥用量的增加,递增等量氮素的增产量,起始时表现为递增,但超过一定限度后则开始递减,总产量曲线呈S型。

1909年E.A.米采利希(Mitscherlich)深入探讨了作物产量与养分供应量之间的关系,并且最早用严格的数学方程式表示其间的数量关系,其数学式为:y=A(1-10-cx)。此式表明,施肥量(y)与产量(x)之间的关系是一指数函数曲线形式,作物产量随施肥量的增加按一定的渐减率增加,而趋向于最高产量为其极限。由于过量施肥,特别是氮肥,对产量常引起负作用,米氏曾提出了一个修正式:

y=A(1-10-cx)10-kx2

式中 k为负效应系数。

W.J.斯皮尔曼(Spillman,1923)进一步提出了米氏方程的同类式:

y=M-ARx

式中 y为养分x的产量;M为理论最高产量;A为理论最高增产量;R为连续两个增产量之比。

大量的科学试验表明,当施肥量超过最高产量施肥量时,作物的产量随施肥量的增加而减少。为了反映超过最高产量后而减产的效应,许多科学家用二次抛物线函数来反映施肥量与产量之间的关系。

y=b0+b1x+b2x2

式中 b0为不施肥的产量水平,即地力产量;b1、b2为效应系数。当b1>0,b2<0时,施肥量与产量的关系呈二次抛物线形式。作物产量随施肥量的增加而按渐减率增加,超过最高产量点后,作物的产量随施肥量的增加而减少。国内外大量的肥料试验,特别是氮肥试验表明,肥料的增产效应往往符合二次抛物线形式。

此外,许多科学家,如J.D.考维尔(Colwell)等用平方根多项式反映肥料效应曲线的变化,其数学式为:

y=b0+b1x0.5+b2x

此式也可反映超过最高产量后总产量递减的效应。当b1>0,b2<0时,作物产量随施肥量的增加而按渐减率增加,但起始时的肥料效应比较明显,此时总产量曲线的斜率较大。而后表现平缓,超过最高点后,总产量随施肥量的增加而减少。

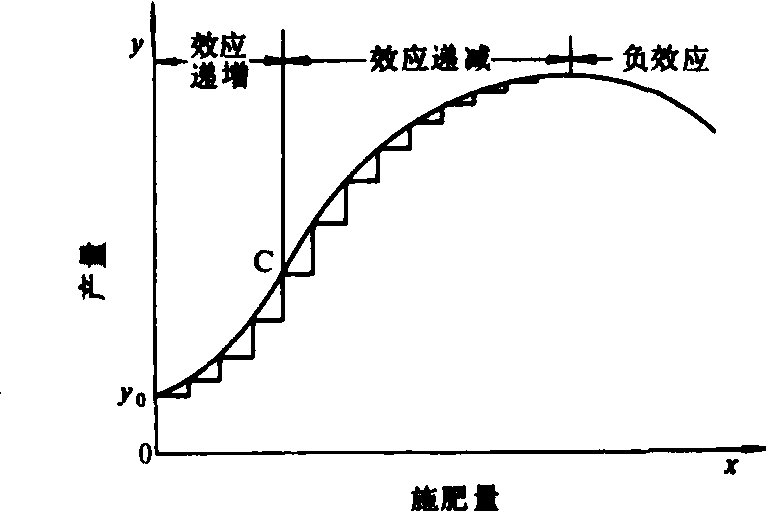

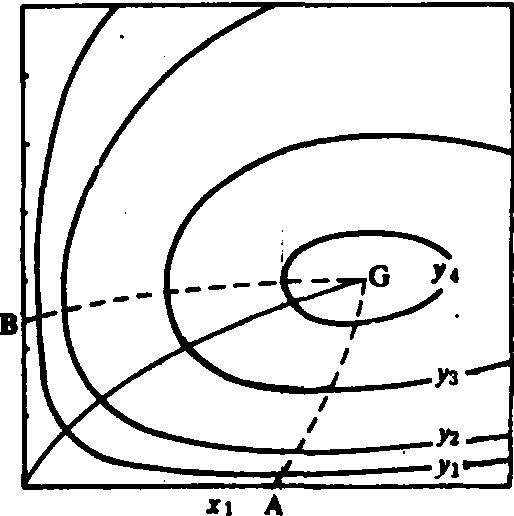

综上所述,在一定的生产条件下,施肥量与产量之间的关系一般呈曲线形式。当作物严重缺乏某种养分时,增施该养分的增产量,起初往往是递增,即增施单位量养分的增产量随施肥量的增加而递增,但超过一定限度后增施单位量养分的增产量便开始递减,当递减为零时,作物产量即达到最大值,此时再继续增加肥料,则将导致减产,肥料效应呈S型曲线(图1)。肥料效应曲线有以下几个特点:❶在土壤供肥水平很低的情况下,增施单位量肥料的增产量随施肥量的增加而递增,直至转向点(图1的C点)时为止;

❷超过转向点后,增施单位量肥料的增产量随施肥量的增加而递减,因而总产量按渐减率增加,直到最高产量时为止;

❸在一定的生产条件下,作物有一最高产量,超过最高产量后,继续增施肥料,则总产量随施肥量的增加而递减,出现负效应,但是总产量的递减率可能小于到达最高产量前的递增率;

❹无限量的增施肥料可能使产量下降为零。

图1 肥料效应曲线模式图

在生产条件下,由于土壤中含有一定数量的养分,常使不施肥的产量水平超过转向点,掩盖了效应递增阶段,因而肥料效应递增的现象不能表现出来。肥料效应往往一开始就表现出递减效应,而呈一曲线形式。

肥料效应曲面 反映两种肥料数量组合与产量之间关系的三维向量。

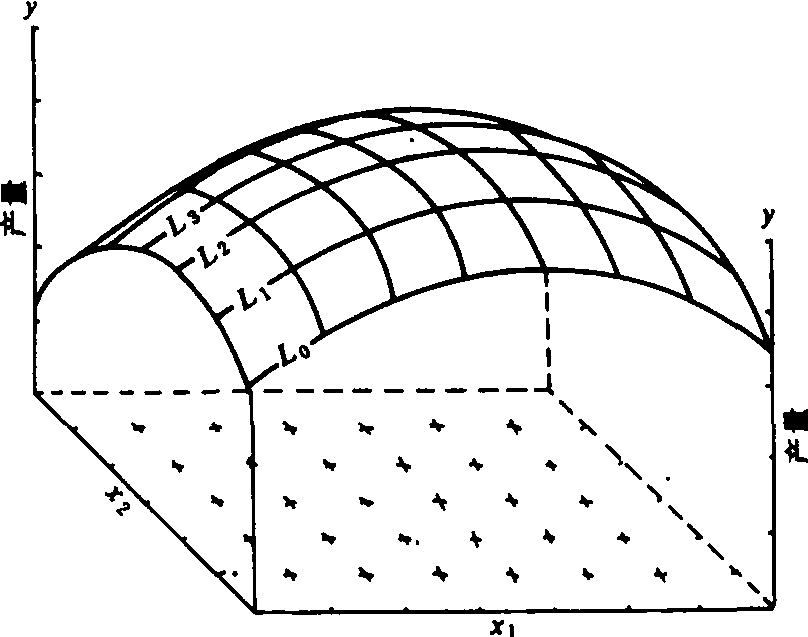

曲面特征 肥料效应曲面是根据二元肥料效应函数绘制而成,如图2所示。

图2 冬小麦氮磷肥效应曲面图

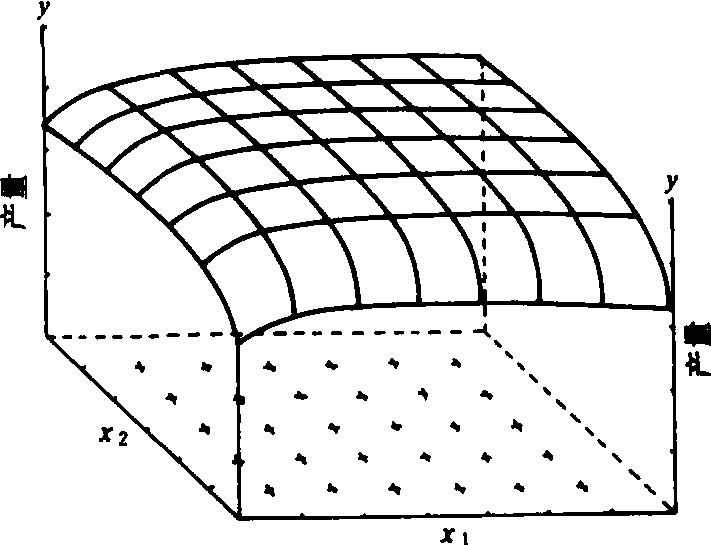

图中x1、x2分别代表两种养分的用量,纵坐标y代表产量。曲面上各个点的高度代表x1、x2一定数量组合所获得的产量。曲面的高度越高,表示产量越高,反之越低。两种养分所获得的最高产量为效应曲面上的最高点。当固定某一种养分的用量时,则作物产量将随另一种养分的施用量而发生变化,如当x2恒定在某一数量时,则曲线L0、L1、L2、L3……为养分x1的效应曲线。当某一养分的增产效应显著时,则该养分的效应曲线将随施肥量的增加而急剧上升。效应曲面也必然沿该养分坐标的方向急剧升高。因此,两种养分的增产效应决定了增产效应曲面的特性。同时,由于两种养分之间常常有一定的交互作用,因而效应曲面必然随两种养分交互作用的特点而发生相应地变化。当交互作用为正效应时,则曲面顶部的曲率较大,当交互作用为负效应时,则曲面顶部比较平坦。由此可见,效应曲面的形式受两种肥料的增产效应及其交互作用的影响。当两种肥料的增产效应均符合报酬递减律时,效应曲面一般呈凸面形。在不同生产条件下,当肥料增产效应及其交互作用表现不同时,肥料效应曲面的形式也不相同。考维尔曾用平方根多项式来反映效应曲面的形式,如图3所示。

图3 玉米氮、磷肥效应曲面图

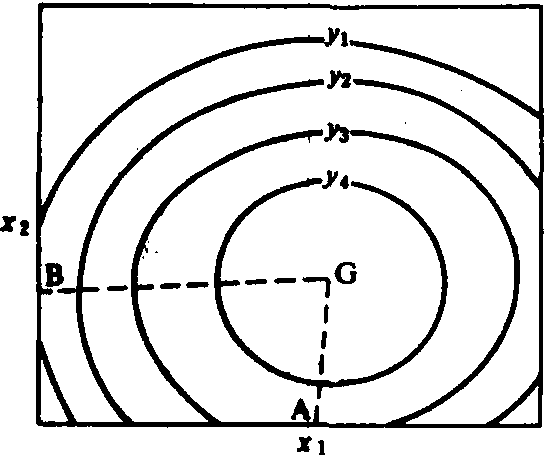

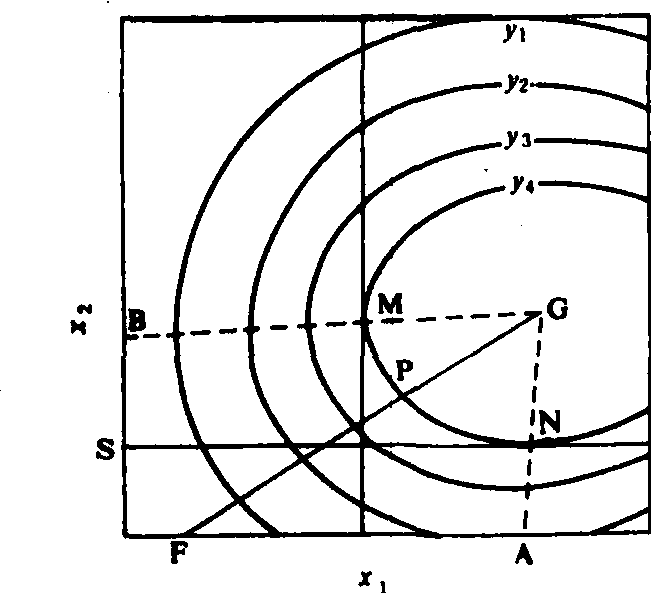

等产线 肥料效应曲面上产量相同的各点的连线在底平面上的垂直投影。图4即为前述冬小麦氮、磷肥效应的等产线图,中心点(图4中G点)即最高产量点。等产线呈椭圆形。等产线距原点越近,其所代表的产量水平越低,反之越高。 产量水平较高的等产线,一般曲率较大,特别是在交互作用为正效应时,尤为明显。不同曲面形式之等产线的形式也表现不同,对于二次多项式,一般为椭圆形,而平方根多项式则为不规则的圆形(图5)。

图4 冬小麦氮、磷肥效应等产线图

图5 玉米氮、磷肥效应等产线图

等产线是根据等产线方程式绘制的。二次多项式所反映的二元肥料效应等产线方程式为:

b0+b1x1+b2x12+b3x2+b4x22+b5x1x2-y=0平方根多项式所反映的二元肥料效应等产线方程式为:

b0+b1x10.5+b2x1+b3x20.5+b4x2+b5x10.5 x20.5-y=0

脊线 等产线上各点的产量相同,但获得该产量的肥料养分配比不同。在一定范围内,一种养分的减少,可以用增加另一种养分的用量来代替,以保持产量不变。如果沿等产线由M点向N点移动(图6),产量水平不变,但养分x1的用量增加,而养分x2的用量减少,至N点时,等产线上该点的斜率为零,此时养分x2的用量是获得该产量水平的最低用量,低于此量则产量下降,增加任何量的x1也不能代替减少的养分x2,而使产量保持不变。同样,等产线上M的斜率为∞,该点的养分x1的用量是获得该产量水平的最低用量,低于此量则产量下降,此时增加任何量的养分x2,同样不能代替减少的养分x1而使产量保持不变。当养分x1的用量超过N点或养分x2的用量超过M点时,只有两种养分同时增加才能保持产量不变,此时两种养分之间已不具有相互代替的性质,只有在M、N点之间的等产线段内,养分间才具有相互代替的性质,因此,M和N点是一定产量水平下养分间具有代替性质的界线。同理,等产线上由中心点向两坐标方向斜率等于0和∞的各点的连线,即GA和GB两条线是养分间具有相互代替性质的分界线,通常称为脊线或代替界线。两条脊线与等产线的交点是一种养分恒定时另一养分的最高产量点。图6中GA线与等产线的交点是养分x2恒定时养分x1的最高产量点。GB线与等产线的交点是养分x1恒定时养分x2的最高产量点。因此,脊线GA和GB线分别是效应曲面上两种养分的最高产量点的连线在底平面上的垂直投影,GA线与GB线的交点,即效应曲面上两种养分的最高产量点。

效应曲面的斜率,经过脊线由正值变为负值。两条脊线的夹角反映了两种养分交互作用的性质,当夹角<90°时,表示交互作用为正效应;当夹角>90°时,为负效应;夹角=90°时则表示无交互作用。两条脊线夹角的大小反映养分间代替范围的大小,当脊线的夹角较大时,表示养分间代替范围较大,即获得同一产量水平的养分配比的变动范围较大,反之则较小。产量水平越低,养分间的代替范围也越大,产量水平越高,养分间的代替范围越小。

不同函数模式的脊线形式表现不同。二次多项式的脊线为直线(如图4),而平方根多项式的脊线则为曲线(如图5)。

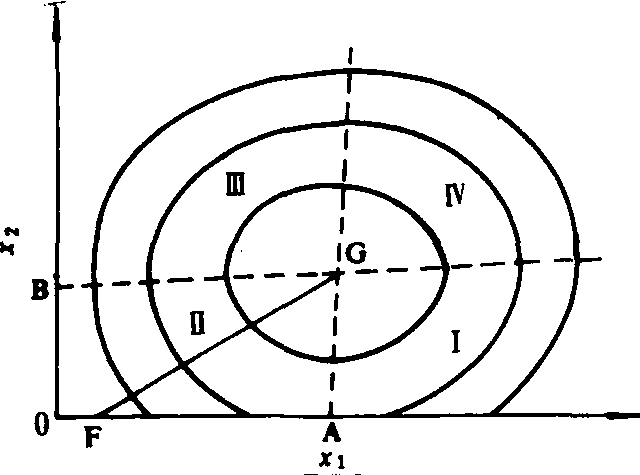

技术合理施肥区 将两条脊线延长即可将肥料效应曲面划分为四个区域,即Ⅰ、Ⅱ、Ⅲ、Ⅳ区(图7)。从各区肥料效应的变化来看,在Ⅰ区范围内,增加养分x1的用量,产量随之减少,说明养分x1的边际产量为负值(

<0);增加养分x2的用量,产量随之增加,说

<0);增加养分x2的用量,产量随之增加,说

由上可知,Ⅰ 、Ⅲ、Ⅳ 区均属于不合理施肥区,只有Ⅱ区是技术合理施肥区。在Ⅱ区范围内,养分间具有相互代替的性质。超出两条脊线的范围,即在 Ⅰ、Ⅱ两个区内,养分间均不具有代替的性质,此时只有同时增加两种养分才能保持产量不变。由此可见,唯有当养分为代替性质时,才符合合理施肥的技术要求。从技术要求上考虑,肥料养分配合比例都应选择在Ⅱ区范围内。然而从经济效益上考虑,在 Ⅱ 区范围内,获得一定产量水平的各种养分配比的经济效益显然不同,其中必有一最佳值。

图6 二次多项式脊线图

图7 肥料效应曲面分区图

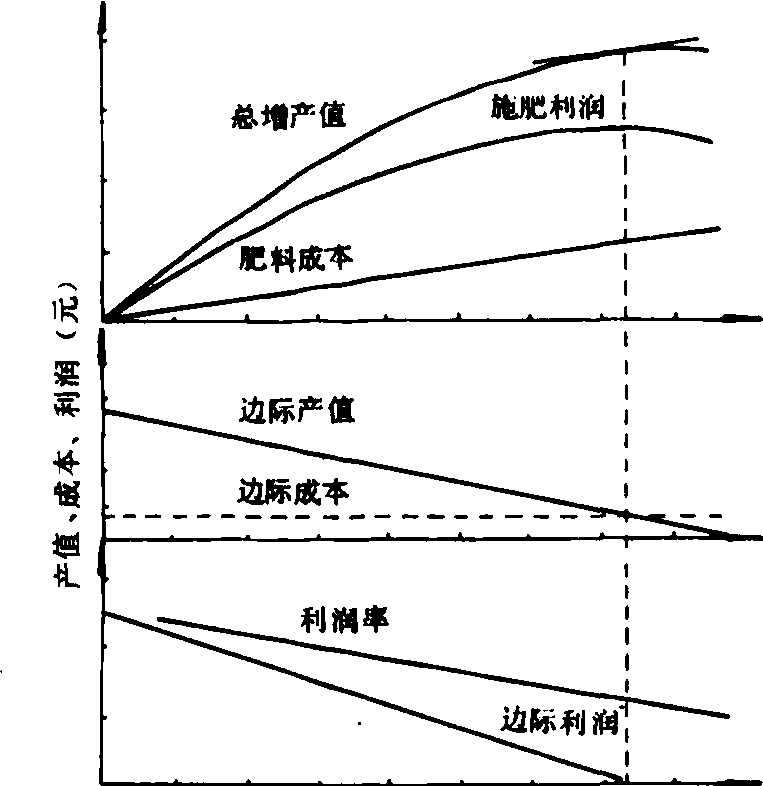

肥料效应的经济分析 当肥料效应的变化符合报酬递减律时,连续增施肥料(△x)时,增产量(△y)不断下降,即

式中 Px、y分别为肥料和产品的单价。在2a阶段,增施肥料的增产值△y·Py大于肥料成本(△x·Px),即边际产值大于边际成本,边际利润R>0,增施肥料都可增加施肥利润,但递增等量肥料的增产值却依次下降。因此,单位面积的施肥利润依渐减率增加。到达2b阶段时,增施肥料的增产值与肥料成本相等,即边际产值等于边际成本,边际利润R=0,此时增施肥料已不能增加施肥利润,单位面积的施肥利润达到最大值。而在20阶段时,增施肥料的增产值小于肥料成本,即边际产值小于边际成本,边际利润R<0,经济效益出现负值,单位面积的施肥利润开始下降。为了获得最大经济效益,施肥量应以2b阶段为最佳施肥点。低于此点,施肥利润相对较低;超过此限,增加肥料反而减少利润,在2b阶段时,

由上式可以看出,当边际产量等于肥料与产品的价格比时,即边际产值等于边际成本时,边际利润等于零,单位面积的施肥利润最大。此时的施肥量即为经济最佳施肥量(图8)。当肥料与产品的价格比改变时,经济最佳施肥量也随之改变,它与施肥的固定成本(施肥时的固定耗费)无关。当施肥量超过经济最佳施肥量后,经济效益显然下降,但产量仍可增加,此时单位量产品的成本相应提高,到达最高产量后,再增加施肥量,则不仅减少经济效益,而且还要减产。从经济效益考虑,施肥量应以经济最佳施肥量为上限,从产量要求出发,施肥量可适当提高,但任何时候也不应超过最高产量施肥量。

氮素用量(kg)

图8 肥料效应的经济效益分析(冬小麦的氮肥效应)

对于多元肥料效应,作物的产量受多种肥料施用量的影响。从经济效益上看,在一定的肥料价格下,必有一经济效益最大的经济最佳配比。根据上述边际效益理论,当每种养分的边际产量都等于该养分与产品的价格比,或每种养分的边际产值均等于边际成本时,即

=Pxi/Py(i=1,2,…,n),单位面积的施肥利润最大,此时的养分配比即为养分的经济最佳配比。此时的施肥量即为经济最佳施肥量。对于二元肥料效应,此配比必然位于经济最佳配比线上,如图6中GF线的P点。在农业生产中,为了保证肥料投资获得高而稳的利润,避免意外自然灾害的风险,常常不施用经济最佳施肥量这样高的肥料用量,而选择R>0的边际利润值来确定施肥量。具体选用的R值应根据肥料投资的数量、肥效的稳定性,以及最优投资的选择而定。边际产量与边际利润的关系如下式:

=Pxi/Py(i=1,2,…,n),单位面积的施肥利润最大,此时的养分配比即为养分的经济最佳配比。此时的施肥量即为经济最佳施肥量。对于二元肥料效应,此配比必然位于经济最佳配比线上,如图6中GF线的P点。在农业生产中,为了保证肥料投资获得高而稳的利润,避免意外自然灾害的风险,常常不施用经济最佳施肥量这样高的肥料用量,而选择R>0的边际利润值来确定施肥量。具体选用的R值应根据肥料投资的数量、肥效的稳定性,以及最优投资的选择而定。边际产量与边际利润的关系如下式:

在有限量肥料投资的情况下,施肥量不能达到经济最佳施肥量,为了获得有限量肥料投资的最大施肥利润,根据边际效益理论,养分经济最佳配比必须符合以下条件:

式中 Pxi为养分xi的单价,M为定量资金。

肥料效应函数 反映施肥量与产量之间的数量关系。由于肥料效应函数的模式不同,所表现的施肥量与产量之间的数量关系也不同。因此,在不同的生产条件下,当肥料的产量效应表现不同时,必须选择不同的肥料效应函数模式,以期能确切的反映该条件下施肥量与产量之间的各种数量关系,并依此计算出经济合理施肥量与肥料养分经济最佳配比。任何一种模式都不可能适用于所有条件。肥料效应函数只能是在一定条件下肥料产量效应数量关系的反映。肥料效应函数模式应当根据田间试验结果所反映的施肥量与产量之间的实际关系来选择。因此,多水平的田间施肥量试验是正确选择模式的基础。

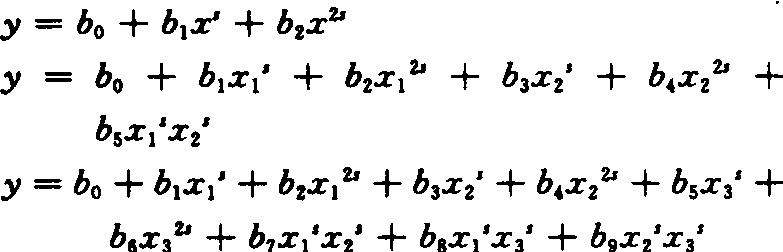

常用的肥料效应函数模式有多项式和指数方程。多项式模式便于应用多元回归分析的方法对试验资料进行分析检验,并可反映养分间的交互作用,同时便于计算经济合理施肥量,因此应用较广。常用的多项式模式有:

式中 y为施用养分xi的产量;b0为不施肥的产量水平;b1,b2,b3……b9为效应系数;s=0.25,0.5,0.75,1。应用较广的是s=0.5或1。

指数方程可表现报酬递减效应,总产量随施肥量的增加而依渐减率趋向于最高产量为极限。因此,此种模式仅适用于到达最高产量前的肥料效应,而不能反映总产量因施肥量增加而下降的效应。最早应用的指数方程式是米采利希方程和斯皮尔曼方程。克劳斯和耶斯提出了一个米氏方程的同类式:

y=y0+d(1-10-kx)

式中 y0为不施肥时的产量;d为可能的最大增产量;x为施肥量;k为效应系数。

经济合理施肥 以获得最大的经济效应为原则。在肥料资金充足的条件下,应当充分发挥土地的增产潜力,提高单位面积的施肥利润,增加总收益,施肥量应以经济最佳施肥量为限,此时单位面积的施肥利润最大。在肥料资金不足的条件下,施肥量较低,土地的增产潜力无法得以发挥,此时应以提高有限量肥料投资的利润为原则,考虑资金条件,投资选择、肥料效应和生产的稳定性等因素,选择适当的边际利润值(R),以确定经济合理施肥量。对于肥料效应表现不同的地块之间的肥料分配,则应根据边际效益理论合理分配,以获得有限量肥料投资的最大经济效益。